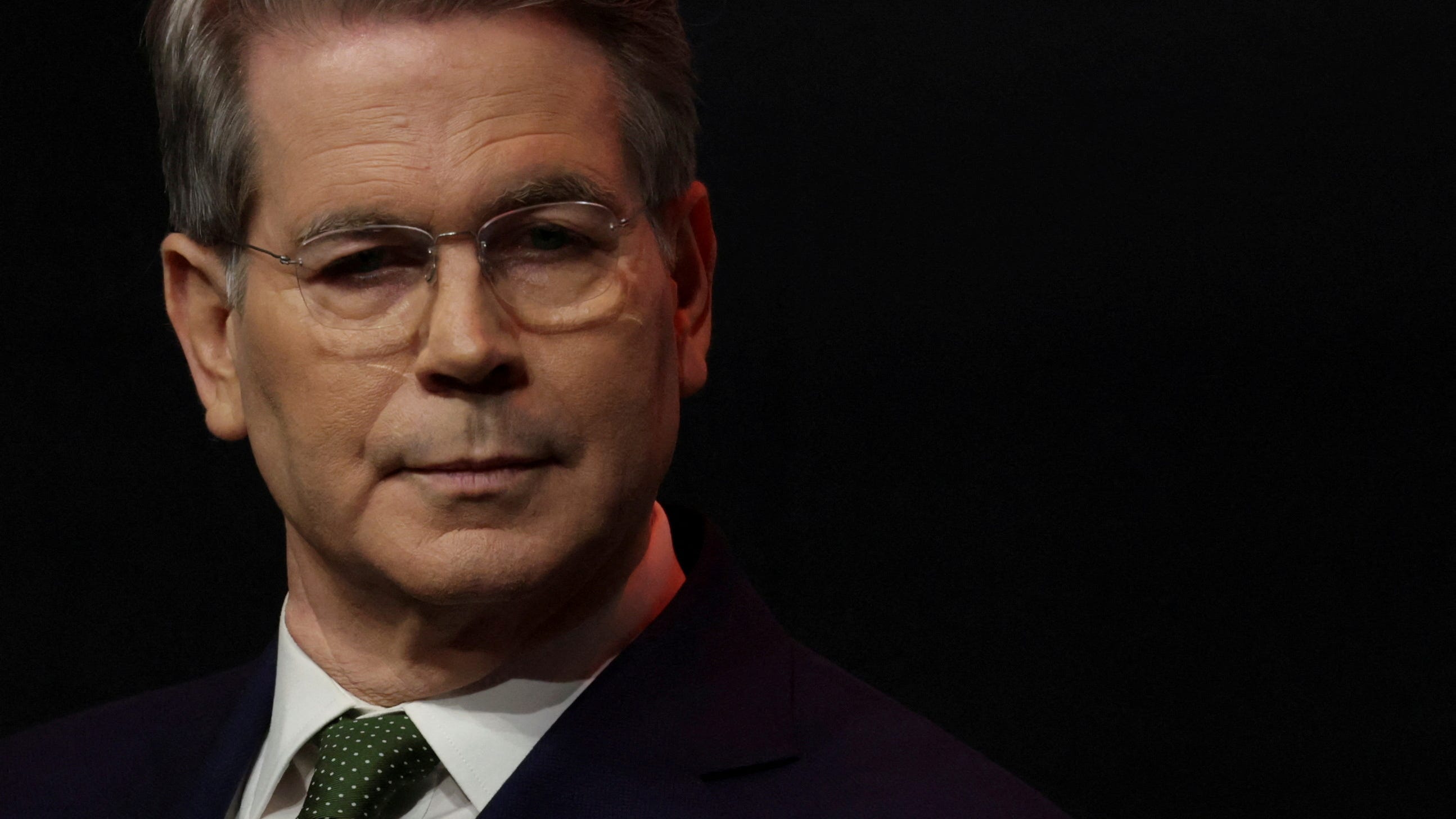

Mnuchin on Tariffs: No Recession Predicted – Expert Analysis & Insights

Editor’s Note: Statements by Steven Mnuchin regarding the economic impact of tariffs have been released today, sparking debate and analysis. This article provides a comprehensive overview of the situation and its potential implications.

1. Why This Topic Matters

The ongoing trade war and the imposition of tariffs are critical topics impacting global and US economies. Statements from former Treasury Secretary Steven Mnuchin regarding the lack of predicted recession carry significant weight, influencing investor confidence and shaping economic forecasts. Understanding Mnuchin's perspective, the supporting arguments, and counterarguments is crucial for businesses, investors, and policymakers alike. This article will delve into Mnuchin's claims, examine the economic data, and explore various expert opinions on the matter. Key aspects we'll cover include the current economic climate, the impact of tariffs on specific sectors, and the potential for future economic shifts.

2. Key Takeaways

| Point | Explanation |

|---|---|

| Mnuchin's Stance | Predicts no recession despite tariffs. |

| Supporting Arguments | Potential positive effects of tariffs on specific industries, strong consumer spending. |

| Counterarguments | Concerns about inflation, potential negative impact on global trade. |

| Economic Indicators | Analysis of relevant data like GDP growth, inflation rates, and unemployment figures. |

| Future Outlook | Exploration of potential scenarios and their implications. |

3. Main Content

Subheading 1: Mnuchin's Claims on Tariffs and Recession

Introduction: Former Treasury Secretary Steven Mnuchin's recent statements dismissing recession predictions in the face of ongoing tariffs have reignited the debate surrounding the economic impact of trade policies. His assertion contradicts concerns raised by numerous economists and analysts.

Key Aspects: Mnuchin's argument likely centers on the strength of the US consumer market and potential benefits for certain domestic industries protected by tariffs. However, critics argue this overlooks potential negative consequences.

Detailed Analysis: A detailed examination of Mnuchin's reasoning is needed, exploring the specific data and models he may have used to reach his conclusion. This section will also analyze the underlying assumptions and potential biases in his perspective. We will compare his predictions with those of other prominent economists and financial institutions.

Subheading 2: Interactive Elements on Tariffs and Economic Impact

Introduction: Understanding the complexities of tariffs and their influence on the economy requires considering various interactive elements.

Facets: Key facets to examine include the interplay between tariffs, inflation, consumer spending, and investment. We will discuss the potential for ripple effects throughout global supply chains and their impact on various sectors like manufacturing and agriculture. Furthermore, the political implications of tariff policies and their influence on economic decision-making will be addressed.

Summary: The interactive nature of these elements makes predicting the ultimate economic outcome challenging, highlighting the importance of ongoing monitoring and analysis.

Subheading 3: Advanced Insights on the Long-Term Economic Effects

Introduction: Beyond immediate impacts, understanding the potential long-term effects of tariffs is crucial for informed policymaking and investment strategies.

Further Analysis: This section will explore potential scenarios, including the possibility of prolonged trade disputes, the impact on technological innovation, and the shifting global economic landscape. We'll analyze the potential for structural changes in various industries as a result of these trade policies. Expert opinions and forecasts from leading economic institutions will be incorporated.

Closing: The long-term effects of tariffs remain uncertain, emphasizing the need for continuous monitoring, adaptable strategies, and proactive policy adjustments.

4. People Also Ask (NLP-Friendly Answers)

Q1: What is Mnuchin's position on tariffs and recession? A: Mnuchin has stated he does not predict a recession despite the imposition of tariffs, citing strong consumer spending and potential benefits for certain domestic industries.

Q2: Why is Mnuchin's stance controversial? A: Many economists disagree with Mnuchin's assessment, arguing that tariffs could lead to inflation, reduced global trade, and ultimately, a recession. The long-term consequences are still debated.

Q3: How could tariffs benefit the US economy? A: Proponents argue tariffs could protect certain domestic industries from foreign competition, potentially boosting employment and production in those sectors.

Q4: What are the potential negative impacts of tariffs? A: Critics point to potential negative impacts such as higher prices for consumers, reduced global trade, retaliatory tariffs from other countries, and disruptions to supply chains.

Q5: How can I stay updated on this issue? A: Follow reputable financial news sources, economic research institutions, and government reports for the latest data and analysis.

5. Practical Tips for Understanding Tariff Impacts

Introduction: Navigating the complexities of tariffs requires staying informed and adaptable.

Tips:

- Monitor key economic indicators (GDP, inflation, unemployment).

- Follow news from reputable financial sources.

- Understand the specific impacts on your industry.

- Diversify investments to mitigate risk.

- Stay informed about government policies.

- Engage in informed discussions and debates.

- Consider consulting with financial advisors.

Summary: By actively monitoring the situation and adapting to changing economic circumstances, businesses and individuals can better navigate the complexities of the tariff debate.

Transition: Let's summarize the key takeaways and discuss the implications of Mnuchin's claims moving forward.

6. Summary

Steven Mnuchin's assertion that tariffs won't cause a recession is a significant statement within the ongoing debate surrounding trade policy. While he points to strong consumer spending and potential benefits for certain industries, many economists express concerns about inflation, reduced global trade, and the potential for negative long-term consequences. The ultimate impact of tariffs remains uncertain, requiring close monitoring of various economic indicators and careful consideration of potential scenarios.

7. Call to Action (CTA)

Ready to dive deeper? Subscribe for more insights on the economic impact of tariffs and related trade policies.