Trump's Impact: ASX & US Stock Market Update – Latest News & Analysis

Editor's Note: This article provides an in-depth analysis of the latest market movements following recent statements and actions by Donald Trump.

This article explores the significant impact of Donald Trump's pronouncements and policies on the Australian Securities Exchange (ASX) and the US stock market. We delve into the key takeaways, analyze market reactions, and provide insights into potential future trends. Understanding this complex interplay is crucial for investors navigating the current economic landscape.

Why This Topic Matters

Donald Trump's influence on global markets remains undeniable. His pronouncements on trade, policy, and even social media can trigger significant volatility in both the US and international markets, including the ASX. This article examines the direct and indirect effects of his actions, helping investors understand the forces shaping their portfolios. We will examine specific examples of market reactions to Trump's statements and assess the long-term implications for both the ASX 200 and major US indices like the Dow Jones Industrial Average and the S&P 500.

Key Takeaways:

| Point | Explanation |

|---|---|

| Trade Tensions: | Trump's trade policies continue to influence market sentiment. |

| Economic Policy: | Shifts in fiscal and monetary policy under Trump’s influence have ripple effects. |

| Geopolitical Events: | Trump’s involvement in international affairs creates uncertainty for investors. |

| Market Volatility: | Trump's pronouncements often lead to increased market fluctuations. |

| Investor Sentiment: | Confidence levels are directly impacted by Trump's actions and statements. |

1. Trump's Impact: ASX & US Stock Market Analysis

Introduction: Understanding the connection between Trump's actions and market performance is critical for informed investment decisions. This section will explore the multifaceted relationship between Trump's influence and market behavior.

Key Aspects: We'll analyze the correlation between specific Trump-related events (e.g., trade negotiations, policy announcements) and subsequent stock market movements in both the US and Australia.

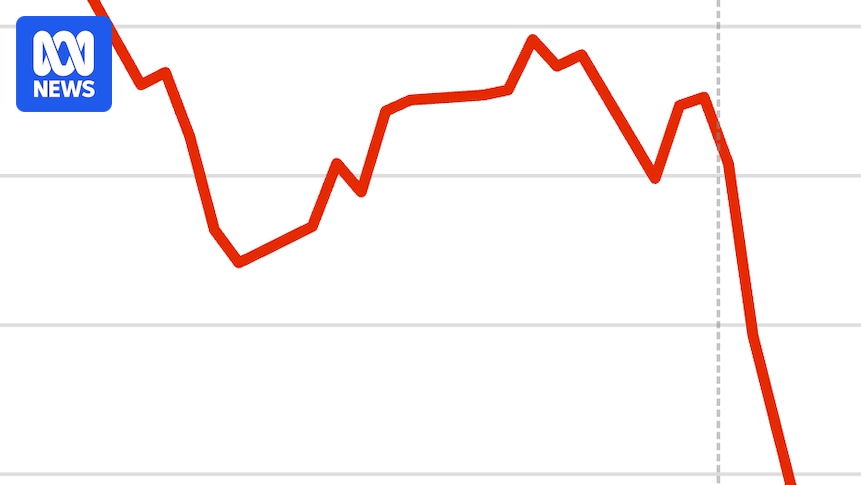

Detailed Analysis: This section will utilize charts, graphs, and data to illustrate the impact of Trump's pronouncements on key market indicators. We'll examine sector-specific responses, identifying which industries are most sensitive to Trump's actions. For example, we will investigate how the energy sector on the ASX reacts to changes in global oil prices influenced by Trump's trade decisions.

2. Interactive Elements on Trump's Market Influence

Introduction: This section explores the dynamic and often unpredictable nature of market response to Trump's influence.

Facets: We will highlight the challenges of predicting market reactions, including the role of media interpretation, investor psychology, and the impact of unexpected events. We’ll also analyze the role of social media in shaping market sentiment during periods of Trump-related news.

Summary: This section emphasizes the complexities of analyzing Trump's influence on markets, highlighting the importance of diversifying investments and adopting a long-term perspective.

3. Advanced Insights on Trump's Lasting Legacy on Markets

Introduction: This section looks beyond short-term fluctuations to examine the potential long-term consequences of Trump's presidency on both the ASX and the US stock market.

Further Analysis: We will analyze the structural changes brought about by Trump's policies and assess their enduring impact on market dynamics. We will also examine expert opinions on the lasting effects of his policies on long-term economic growth in both countries.

Closing: This section will offer a concluding perspective on the legacy of Trump's influence on markets, considering the long-term implications for investors.

People Also Ask (NLP-Friendly Answers)

Q1: What is Trump's impact on the ASX? A: Trump's actions, particularly regarding trade and international relations, can cause significant volatility on the ASX due to Australia's close economic ties with the US and China.

Q2: Why is Trump's influence on the US stock market important? A: The US market is the world's largest, making its fluctuations crucial for global financial stability. Trump’s policies directly influence this market, impacting investors worldwide.

Q3: How can I mitigate the risk of Trump's market impact? A: Diversification is key. Spreading investments across different asset classes and geographical regions reduces exposure to the volatility caused by a single political figure.

Q4: What are the main challenges in predicting Trump's market impact? A: The unpredictability of his actions and the complex interplay of various economic factors make accurate prediction challenging.

Q5: How to stay informed about Trump's impact on markets? A: Regularly follow reputable financial news sources and consult with a financial advisor for personalized guidance.

Practical Tips for Navigating Trump's Market Influence

Introduction: This section offers actionable strategies for investors to manage risk and capitalize on opportunities amidst the uncertainty created by Trump’s influence.

Tips:

- Diversify your portfolio across asset classes and geographies.

- Stay informed about current events and market trends.

- Consult with a financial advisor for personalized guidance.

- Develop a long-term investment strategy.

- Regularly review and adjust your portfolio based on market conditions.

- Consider hedging strategies to mitigate risk.

- Pay attention to sector-specific responses to Trump’s actions.

- Avoid emotional decision-making based on short-term market fluctuations.

Summary: These tips can help you navigate market uncertainty and make informed investment decisions despite the volatility caused by Trump’s influence.

Transition: By implementing these strategies, you can position yourself for success in a constantly evolving market environment.

Summary

This article analyzed the multifaceted impact of Donald Trump's actions and policies on the ASX and the US stock market. From trade tensions to shifts in economic policy, we’ve explored the key drivers of market volatility and offered practical strategies for investors to navigate this complex landscape.

Call to Action

Ready to dive deeper? Subscribe for more insights on market analysis and investment strategies!