Trump: Powell licencié? Avenir de la Réserve Fédérale

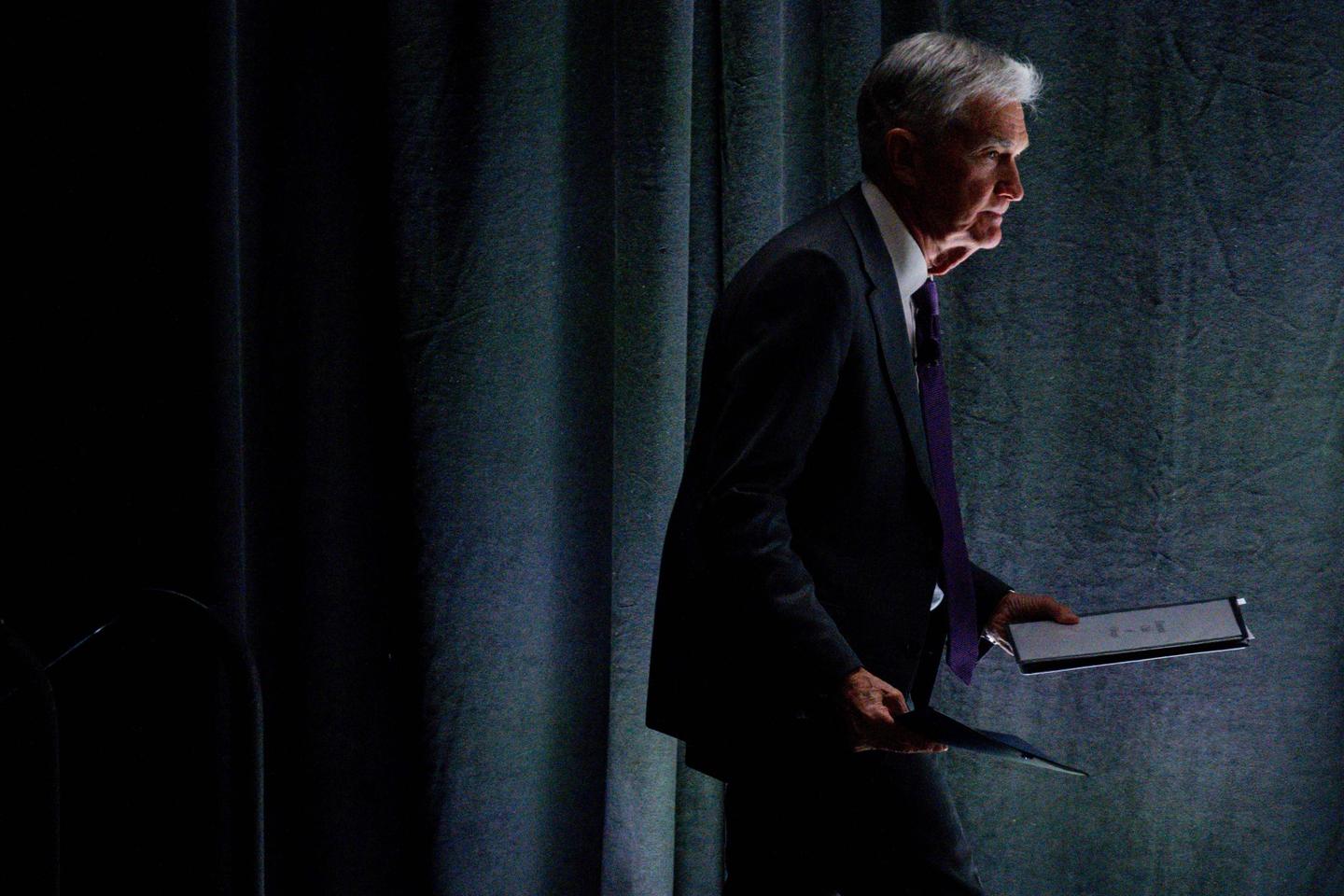

Editor’s Note: Speculation surrounding the potential dismissal of Jerome Powell as Federal Reserve Chair continues to dominate headlines. This article explores the implications of such a move and the future direction of the Federal Reserve.

Why This Topic Matters

The possibility of President Trump dismissing Jerome Powell, the Chairman of the Federal Reserve, is a significant event with far-reaching consequences for the US and global economy. Powell's leadership, particularly his approach to interest rate hikes and inflation management, has been a subject of intense debate and scrutiny. Understanding the potential outcomes of his potential dismissal is crucial for investors, businesses, and policymakers alike. This article will delve into the key aspects of this situation, examining the potential repercussions for monetary policy, market stability, and the overall economic outlook. Keywords like "Jerome Powell," "Federal Reserve," "Trump," "interest rates," "inflation," and "monetary policy" will be strategically incorporated throughout.

Key Takeaways

| Aspect | Potential Outcome | Impact |

|---|---|---|

| Powell's Dismissal | Significant market volatility, erosion of Fed independence, potential legal challenges | Uncertainty in financial markets, reduced investor confidence |

| Replacement Candidate | Uncertain; could lead to shifts in monetary policy, potentially impacting inflation and growth | Economic instability, shifts in interest rate targets, potential policy reversals |

| Economic Impact | Increased uncertainty, potential for market crashes, heightened inflation risk | Decreased consumer spending, potential recessionary pressures |

| Political Implications | Increased political polarization, questions about executive overreach | Damage to US global standing, potential for international market instability |

1. Trump: Powell licencié?

Introduction: The ongoing tension between President Trump and Federal Reserve Chairman Jerome Powell has raised serious questions about the future of the central bank's independence. President Trump has openly criticized Powell's monetary policy decisions, particularly the interest rate hikes implemented to combat inflation. This open criticism, unprecedented in its intensity, has fueled speculation about a potential dismissal.

Key Aspects: The key aspect here is the unprecedented level of public criticism from the President towards the Federal Reserve Chair. This undermines the traditional independence of the central bank, a cornerstone of a stable economy.

Detailed Analysis: The potential for political interference in the Fed's operations is deeply concerning. A dismissal would signal a departure from established norms and could create significant uncertainty in the markets. Historically, Fed Chairs have enjoyed a degree of autonomy, allowing them to make decisions based on economic data rather than political pressure.

2. Interactive Elements on the Future of the Federal Reserve

Introduction: The future of the Federal Reserve hangs in the balance. The uncertainty surrounding Powell's position creates a complex scenario with several potential outcomes.

Facets: Key facets include the potential for market volatility, the selection of a successor, and the subsequent shift in monetary policy. Risks include a loss of investor confidence, increased inflation, and a potential recession. Challenges involve navigating political pressure while maintaining economic stability. The reward, if handled correctly, could be a restoration of trust in the Fed's independence.

Summary: The interactive nature of this situation highlights the interconnectedness of politics and economics. The actions taken—or not taken—will significantly impact the stability and future trajectory of the US economy.

3. Advanced Insights on the Future of the Federal Reserve

Introduction: A deeper understanding of the potential consequences requires analyzing various scenarios and considering the perspectives of economists and market analysts.

Further Analysis: Experts warn that a dismissal could trigger a sell-off in financial markets, leading to increased volatility. The choice of a successor will be critical, with implications for future interest rate decisions and the overall direction of monetary policy. The long-term consequences could include a decline in the US dollar's value and a rise in global inflation.

Closing: The future of the Federal Reserve under a new chair remains uncertain. However, careful consideration of the potential consequences and a commitment to maintaining the Fed's independence are crucial for ensuring the stability of the US and global economy.

People Also Ask (NLP-Friendly Answers)

Q1: What is the current situation with Jerome Powell and the Federal Reserve? A: President Trump has publicly criticized Jerome Powell's leadership of the Federal Reserve, raising concerns about his potential dismissal.

Q2: Why is the potential dismissal of Jerome Powell important? A: It raises concerns about the independence of the Federal Reserve and its ability to make decisions based solely on economic data, rather than political pressure. This could lead to economic instability.

Q3: How could this affect me personally? A: Increased market volatility could impact your investments, savings, and purchasing power. Economic instability may lead to job insecurity or reduced opportunities.

Q4: What are the main challenges with this situation? A: Maintaining the independence of the Federal Reserve, navigating potential political pressure, and ensuring economic stability are major challenges.

Q5: What should I do? A: Stay informed about economic developments, diversify your investments, and maintain a balanced budget.

Practical Tips for Navigating Economic Uncertainty

Introduction: Uncertainty can be stressful. Here are some practical tips to help you navigate the potential economic fallout.

Tips:

- Diversify your investment portfolio.

- Monitor your spending habits.

- Pay down high-interest debt.

- Build an emergency fund.

- Stay informed about economic news.

- Consider consulting a financial advisor.

Summary: Taking proactive steps can help mitigate the risks associated with economic uncertainty.

Transition: Understanding the potential implications of this situation is crucial for informed decision-making.

Summary

The potential dismissal of Jerome Powell is a significant event with potentially far-reaching consequences for the US and global economy. Maintaining the independence of the Federal Reserve is crucial for economic stability. The future direction of monetary policy will significantly impact inflation, growth, and market stability.

Call to Action

Ready to dive deeper? Subscribe for more insights on the future of the Federal Reserve and its impact on the global economy.